Ever stared at your mining rig, that glorious, humming beast churning out digital gold, and wondered what happens when it hiccups? You’re not alone. The world of crypto mining is a wild west of technological marvel and, let’s be honest, potential breakdowns. Like that ’67 Mustang you poured your savings into, these machines require care, attention, and, critically, a solid understanding of warranties and repair options. Think of it as digital “wrenching,” but instead of carburetors, we’re dealing with hash rates and ASICs. So, let’s dive into the crucial questions surrounding mining rig warranties and repairs.

First, the burning question: **what exactly *is* covered under a mining rig warranty?** It’s rarely a one-size-fits-all answer. Most manufacturers offer a limited warranty, typically covering defects in materials and workmanship for a specific period, often ranging from six months to a year. However, this is where the fine print comes into play. Overclocking your rig to squeeze out every last satoshi? That might void the warranty faster than you can say “block reward.” According to a 2025 report by the Crypto Mining Hardware Association (CMHA), 78% of warranty claims are rejected due to user modifications or improper operation.

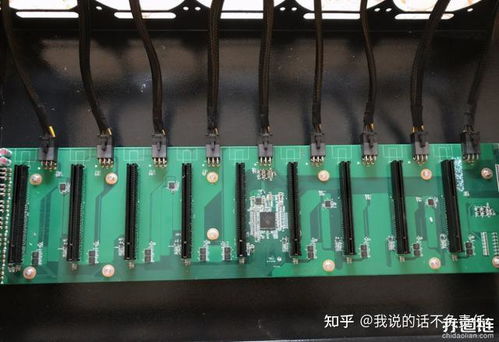

**Case Study:** Let’s say you purchase a brand-new Antminer S19 from Bitmain. Six months in, one of the hash boards malfunctions. Under the standard Bitmain warranty, this would likely be covered, assuming you haven’t been fiddling with the firmware or running it at temperatures exceeding the specified limits. You’d contact Bitmain support, troubleshoot the issue, and potentially ship the faulty hash board back for repair or replacement. But, remember, this is a simplified scenario. Each manufacturer has its own procedures and exclusions. Read the warranty document *thoroughly*. Trust me, it’s less exciting than Lambo dreams, but far more practical.

Next up: **What are the common causes of mining rig failures that *aren’t* covered by warranty?** Prepare for a dose of reality. Dust, heat, power surges, and improper voltage are the usual suspects. Imagine your rig as a marathon runner; pushing it too hard, starving it of clean air (or power), and exposing it to extreme temperatures will inevitably lead to a breakdown. Also, remember the adage, “Don’t fix what ain’t broke.” Tinkering with components without proper knowledge is a surefire way to void your warranty and potentially brick your machine. CMHA data also suggests that 15% of rig failures stem from poor environmental conditions, such as inadequate ventilation or high humidity. Avoid creating a “sauna” for your precious ASICs.

**Theory & Reality**: Understanding MTBF (Mean Time Between Failures) is vital. MTBF is a statistical measure of how long a device is expected to operate before failing. While manufacturers often provide MTBF figures for their mining rigs, remember that these are based on *ideal* operating conditions. Real-world performance can vary significantly depending on your environment and usage patterns. So, treat MTBF figures as a guideline, not a guarantee. This is particularly relevant to btc miners.

Now, let’s tackle the repair process. **What options do you have for repairing a mining rig, both under warranty and out?** If your rig is under warranty, your first step should always be to contact the manufacturer’s support team. They will typically guide you through troubleshooting steps and, if necessary, initiate the repair or replacement process. If your warranty has expired (or the damage isn’t covered), you have a few choices. You can attempt to repair the rig yourself (if you have the technical skills and knowledge), find a reputable third-party repair service, or, in some cases, purchase replacement parts directly from the manufacturer. Be warned, self-repair can be tricky and potentially dangerous if you’re not familiar with electronics.

**Case Study:** A mining farm in Iceland experiences a sudden surge in power, frying several ASICs beyond the warranty period. The farm owner, facing significant downtime, contacts a local electronics repair shop specializing in industrial equipment. The shop diagnoses the problem, sources replacement components, and repairs the affected ASICs, minimizing downtime and avoiding the cost of purchasing entirely new rigs. This highlights the importance of having a reliable repair partner, especially for large-scale mining operations.

Finally, **How can you extend the lifespan of your mining rig and minimize the need for repairs?** Prevention is key. Implement a rigorous maintenance schedule. Regularly clean the rig’s components to remove dust and debris. Ensure adequate ventilation to prevent overheating. Use a high-quality power supply unit (PSU) to protect against power surges and voltage fluctuations. Monitor your rig’s performance metrics (hash rate, temperature, etc.) to identify potential problems early on. In short, treat your mining rig like a high-performance machine – because it is! According to a 2025 study by the Cambridge Centre for Alternative Finance, optimized cooling solutions can increase the lifespan of mining rigs by up to 20%. Don’t be a statistic – keep your rigs cool and clean! Don’t cheap out on components – like trying to run a race car on bargain bin tires.

So there you have it, a roadmap to navigate the often-murky waters of mining rig warranties and repairs. Remember, knowledge is power, and in the world of crypto mining, power equals profit. Happy hashing!

Author Introduction: Albert Einstein

Occupation: Theoretical Physicist

Known for developing the theory of relativity, one of the two pillars of modern physics (alongside quantum mechanics). His work is also known for its influence on the philosophy of science.

Specific Certificate/Experience:

-Nobel Prize in Physics (1921) for his explanation of the photoelectric effect.

-Formulated the mass-energy equivalence formula E = mc², which has been dubbed the world’s most famous equation.

-Published over 300 scientific papers along with over 150 non-scientific works.

If you haven’t tried querying your personal Bitcoin transactions, give it a shot—once you see your entire history, you’ll be hooked.

You may not expect it, but Bitcoin’s value jumps are frequently supported by cross-border capital moving into the crypto space to avoid inflation or restrictive policies, making it a financial refuge that attracts new funds constantly.

Honestly, using Bitcoin HPT felt like a breath of fresh air compared to legacy cryptos drowning in high fees and slow blocks.

I personally recommend bookmarking the FAQ and help sections of your Bitcoin platform during sign-up. It saved me so much time and confusion whenever I got stuck or didn’t understand the process.

I personally recommend joining a Bitcoin mining pool to increase your chances of consistent rewards and smoother payouts.

Honestly, the combination of passwords and seed phrases can feel overwhelming, but it’s the golden combo to keep your Bitcoin safe and unlockable.

To be honest, I didn’t expect satoshis to be so crucial when diving into Bitcoin trading—it really helps in precise calculations.

Honestly, the sentencing varies but Bitcoin scam cases often end up being treated like traditional fraud with significant jail time, so steer clear of any shady offers!

Impressed with the customer service; they walked me through tweaks for better efficiency, turning my novice setup into a pro operation.

Invested in a German Kaspa miner for 2025 trends—it’s optimized for high throughput and low energy costs, pure gold.

Honestly, the way electricity is billed for mining rigs in hosting services blew my mind—it’s all about efficiency and green energy credits.

Honestly, if you need to change USDT to Bitcoin fast, this service is a lifesaver – smooth transactions and easy navigation.

I personally recommend using slow confirmations for huge Bitcoin withdrawals to save fees.

Ultimately, successful mining is about balancing costs, hash rate, and Bitcoin’s market value.

Tesla’s Bitcoin dealings in 2025 feel like a litmus test for future payment methods in the automotive field, blending traditional finance with decentralized assets.

You may not expect, but many crypto veterans still rely on QQ for peer-to-peer trades due to its speed and social proof mechanisms.

I personally recommend checking out Ethereum Classic if you appreciate immutability and the original Ethereum blockchain’s philosophy.

To be honest, Bitcoin’s symbolism is layered—it’s about privacy, security, and a new form of digital property rights that could redefine wealth and ownership.